Whether they’re native sons and daughters returning home for deer season or diligent workers hoarding money and time-off for an annual “hunt of a lifetime,” nonresident hunters consistently participate at higher rates than resident hunters east and west of the Mississippi River.

At least that’s what some extensive “back-of-the-envelope” calculations revealed after American Hunter recently compiled and studied hunter data, license sales and hunt-application figures from 12 popular hunting states. Representing whitetail country in this review were Ohio, Iowa, Minnesota, Wisconsin, Michigan, New York and Pennsylvania; and representing elk and/or muley country were Colorado, Arizona, Wyoming, Montana and South Dakota.

We compared the participation rates of resident and nonresident hunters after noticing something interesting about two Wisconsin deer camps we’ve long known, one in the state’s Northwoods and one in farm country. Combined, their camp rosters include nine hunters, nearly half of whom are nonresidents. Of the camps’ four nonresidents, three are native Wisconsinites who left home years ago for work, college, marriage and/or military service. The other nonresident joined the Northwoods camp years ago through a friend-of-a-friend request.

Three of those four nonresidents grew up hunting deer at one of the camps and return home regularly to hunt during November’s gun-deer season. One hasn’t missed a season since moving to Virginia about six years ago. And of the four, three have access to good deer hunting near home, but consistently put more time and money into their Wisconsin trip most autumns.

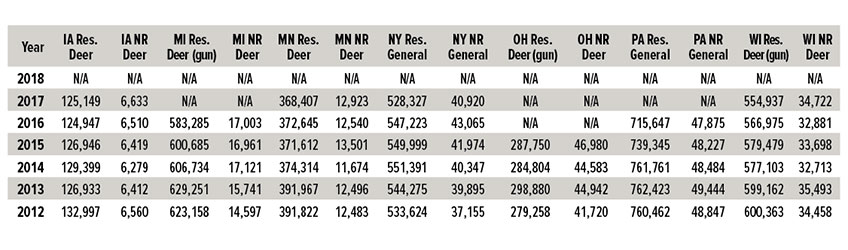

Such loyalty doesn’t make those hunters unique, however. Consider: Wisconsin had roughly 654,000 resident gun-deer hunters in 1999 and 554,937 in 2017, a 15 percent decline. Meanwhile, Wisconsin had about 36,400 nonresident gun-deer hunters in 1999 and 34,722 in 2017, a 4.6 percent decline.

Granted, both categories declined this century, but nonresidents dropped out about two-thirds more slowly than did residents. And when you review recent seasons, Wisconsin actually sold 1 percent more nonresident gun-deer licenses in 2017 than it did in 2012 (34,458). Meanwhile, its resident gun-deer license sales fell 7.6 percent between 2012 (600,363) and 2017.

Consistent Patterns

Those loyalty gaps aren’t unique to Wisconsin. That trend was much the same across most of the seven whitetail states we surveyed, with resident gun-deer licenses down but nonresident sales up in Iowa, Minnesota, Michigan and New York; while both categories were up in Ohio and down in Pennsylvania.

Western states, in contrast, are documenting growing interest in both residents and nonresidents. These states are bucking nationwide declines in hunting participation; and their high-priced nonresident deer (and elk) licenses aren’t discouraging out-of-state hunters, despite being far more expensive than Eastern states’ nonresident fees.

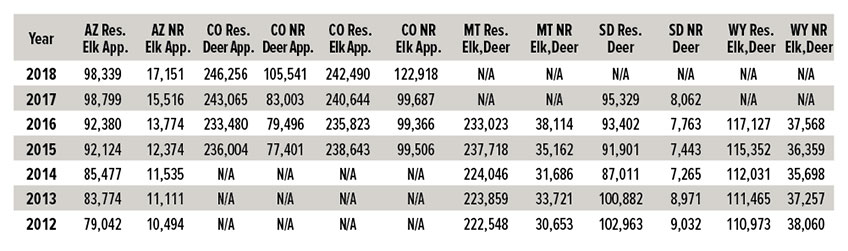

Colorado, Arizona and Montana saw increasing interest in resident and nonresident applications for elk and deer licenses from 2012 to 2017. And even when looking at actual license sales, Wyoming sold 5.5 percent more resident elk and deer tags in 2016 (117,127) than in 2012 (110,973), and only 1.3 percent fewer nonresident elk and deer tags in 2016 (37,568) than in 2012 (38,060). Only South Dakota’s gun-deer license sales declined in both categories, with a 7.4 percent slide in resident deer hunters from 2012 (102,963) to 2017 (95,329), and an 11 percent decline in nonresident deer hunters from 2012 (9,032) to 2017 (8,062).

We concede, of course, that it’s difficult to precisely compare hunter numbers and license sales or permit applications between states. The process is fairly similar in Eastern states, where big-game hunting mostly means white-tailed deer with a smattering of black bears. Most Eastern states also sell deer licenses over the counter with no cap. But even then license-sales data aren’t always quickly available after each season for comparisons. Further, some states have expanded, reduced or redefined license categories in recent years to help retain or attract hunters.

Even so, comparisons to and among Western states are far more complicated because of multiple big-game species, widely varying habitats, multiple seasons per species, varying quotas by sex and species, varying license-application deadlines, and fewer on-demand/over-the-counter license sales.

Colorado, for example, offered 1,020 different hunting seasons in 2018 for elk alone, which required a 927-page report to assess how many residents, nonresidents and landowners applied for those hunting opportunities. Further, Western states closely regulate how many nonresident tags to allocate each year as part of each species’ quota.

Nonresidents are Stalwarts

Despite all those complications, one trend remains clear in the 12 states reviewed for this summary: Nonresidents remain stalwart hunters, despite general declines in hunting numbers and higher-priced licenses. Of the 12 states we surveyed, nine (75 percent) reported increased nonresident license sales and/or license applications since 2012. In contrast, only five of those 12 states (42 percent) reported increased resident sales or applications. Further, only four—Ohio, Colorado, Arizona and Montana—reported increases in both categories.

Assessing the reasons behind nonresidents’ devotion isn’t so easy to find in charted numbers, of course. Still, we can assume many hunters have family roots and other emotional ties to states where they grew up hunting. We can also assume those who commit time and money to out-of-state hunts are likely passionate hunters who seek more adventures and experiences than do casual hunters.

Whatever the motivations might be, they’re powerful. Participation rates since 2012 by nonresident hunters outpaced those of resident hunters in 10 of the 12 states we reviewed. Further, where resident participation rates were greater (Wyoming and South Dakota) the differences were only 6.8 and 3.5 percentage points, respectively.

The takeaway: If states could somehow instill those motivations in all hunters, the nation would have far fewer concerns about hunting’s future.