“Oh, you hunt,” said a professor, her fork poised in the air with chicken Caesar stuck on its prongs. “Haven’t we visited enough violence on nature?”

I had tried to keep the conversation on other things, but this professor wanted to find a stereotype to judge me by and so she worked to tease what I do out of me. When I told her what I investigate and write about she raised her chin as she grew the usual moral vanity that so often numbs the brains of the modern intellectual elite.

The seven people around the white-linen-covered table in the elegant restaurant all grew quiet. They all have Ph.D.s. I don’t. My wife, a college professor, was stepping on my foot.

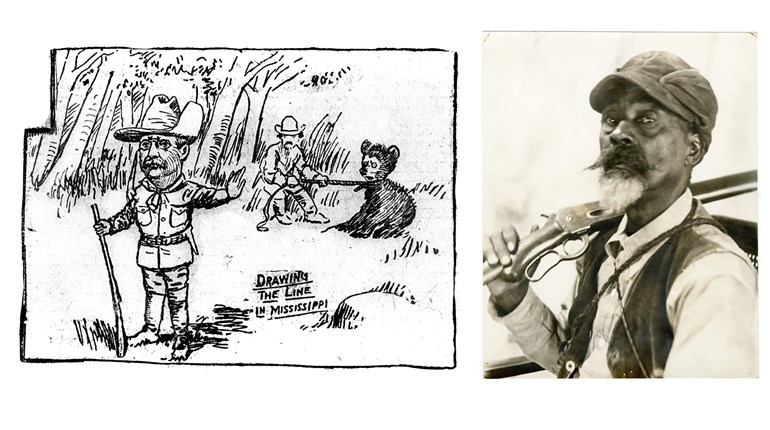

I smiled. I like directness, as it provides a chance to debate, but I needed to come at this from a friendly angle, so I asked her, “Have you heard about the wood bison that were reintroduced in Alaska?”

Her eyes narrowed.

“The state trapped and transferred 150 of them from Canada,” I said. “The bison had calves this spring—the first bison calves born in Alaska in a long time.” I paused for emphasis before saying, “The state paid for the reintroduction with money raised from taxes on guns and ammunition.”

She put down her fork.

“Some of the funds also came from hunting license fees,” I said, “as, according to the 1937 federal law, the state must match 25 percent of the funds they receive from the Pittman-Robertson taxes on guns, ammunition and such things, and states typically do that with funds raised from the sale of hunting and fishing licenses.

“These taxes paid for the return of elk, antelope, white-tailed deer, wild turkeys and have been used to buy or lease 68 million acres for conservation purposes,” I said, knowing that this professor was likely from the left side of the political spectrum. Such types tend to be fond of taxes that other people pay, and they prefer federal experts to manage everything. In this case she had both of those things, and, of course, this was an example of individual Americans taking freedom in their own hands to make it all work.

Her expression told me this was too much reality for her. She would have probably been more comfortable in the opaque topic of climate change.

I stopped even though I hated stopping—it would have been fun to talk about the chicken she was eating and how hunters manage game populations for the good of the environment, and so much more. But my wife hadn’t stomped on my foot yet. If I could avoid giving this professor a public shaming, it would be much better all around.

The professor’s eyes searched the expressions around the table and then looked down. I could almost see her looking into the deep chasm of her ignorance in regard to the environment. She glanced back up and her eyes were glassy. She said, “Good to hear the money is helping the natural world.”

Certainly, as hunters, these are conversations we must be prepared for with the facts—facts we should also be teaching our children.

The Ammunition for a Conservation Discussion

Congress passed the Pittman-Robertson Wildlife Restoration Act in 1937. Pittman-Robertson places a 10 percent tax on pistols and revolvers; an 11 percent tax on other firearms and ammunition; and an 11 percent tax on bows, quivers, broadheads and points. The revenues raised from these taxes are managed by the U.S. Fish and Wildlife Service (USFWS). The USFWS keeps a small portion (usually around 1 percent) for administrative fees and apportions the rest to the states according to a formula. The formula is based on the area of the state (50 percent) and the number of paid hunting license holders (50 percent) in each state. Also, no state may receive more than 5 percent, or less than one-half of 1 percent, of the total apportionment.

But the USFWS doesn’t just write checks to the states every year. The states must apply for grants. They must match every $3 with $1 from a non-federal source. The grants must fit into very specific categories outlined by Congress in the original law and in subsequent amendments. Funds not used by the states within two years revert to the USFWS for carrying out the provisions of the Migratory Bird Conservation Act.

Since 1937, Pittman-Robertson has contributed more than $9.9 billion to:

• Restore, conserve, manage and enhance wild bird and mammal populations;

• Acquire and manage wildlife habitats;

• Provide public uses that benefit from wildlife resources;

• Educate hunters on conservation ethics and safety; and

• Construct, operate, and manage recreational firearm shooting and archery ranges.

States have matched this $9.9 billion with more than $2.4 billion. This conservation money from the products you buy to enjoy your sports feeds a critical part of our conservation economy. The National Shooting Sports Foundation (NSSF) estimates that, on a daily basis, about $3.5 million is contributed through excise taxes and license fees to wildlife conservation.

This funding from hunters and gun owners has long been critical to the restoration of many species of wildlife, including the bald eagle and many endangered species. While these funds help game populations such as whitetails, elk, ruffed grouse, caribou, waterfowl and more, non-game animals also benefit, including songbirds, peregrine falcons, sea otters and many other wildlife species.

The smugness of that professor I spoke to is really just ignorance masquerading as moral vanity. Sure, she didn’t know taxes on the billions of rounds of ammunition Americans shoot every year helped the wood bison return to Alaska. She also is blithely unaware of the many local projects these taxes fund all over America.

Christy Vigfusson, chief of the programs branch for the USFWS Wildlife and Sport Fish Restoration Programs, said, “In 2018, we anticipate that over $140 million will be available to assist states in providing hunter education, shooting and archery ranges, and young hunter programs. States’ hunter education programs have trained more than 39 million students in hunter safety over a span of 47 years. This effort has resulted in a significant decline in hunting-related accidents and has increased the awareness of outdoor enthusiasts about the importance of individual stewardship and conserving America’s resources.”

Your tax money does so much good for wildlife and our sports that it is impossible to quantify in one magazine article. States use about 60 percent of Wildlife Restoration funds to purchase, lease, develop, maintain and operate wildlife management areas for everyone to use. States use about 26 percent of Wildlife Restoration funds annually for wildlife surveys and research, enabling biologists and other managers to put science foremost in restoring and managing wildlife populations. Many states have been successful in restoring numerous species to their native ranges thanks to this revenue, including the Eastern and Rio Grande turkey, antelope, wood duck, beaver, black bear, giant Canada goose, desert and Rocky Mountain bighorn sheep and many species of birds.

How much of this tax actually benefits hunting and hunters, specifically? According to Southwick Associates, a market research firm that specializes in hunting, shooting and other outdoor recreation markets, as of 2015, firearms made up 57.4 percent of retail dollars generated from Pittman-Robertson. Other taxable products include ammunition (32.3 percent of sales dollars) and archery products (10.3 percent). Of firearm sales dollars, 20.2 percent can be assigned to hunting purposes and the remainder (79.8 percent) to non-hunting purposes. Of ammunition sales dollars, 26.6 percent can be assigned to hunting purposes, and the remainder (73.4 percent) to non-hunting purposes. For firearms and ammunition combined, 22.5 percent can be assigned to hunting purposes, and the remainder (77.5 percent) to non-hunting purposes.

Save this article. Remember these statistics. The next time you encounter ignorance masquerading as moral vanity, use them.